Market Outlook

May 04, 2017

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to remain flat tracking the SGX Nifty & global cues.

BSE Sensex

(0.1)

(26)

29,895

After spending much of the day in negative territory, the major US markets ended

Nifty

(0.0)

(2)

9,312

Wednesdays trading mixed following the Federal Reserves monetary policy

Mid Cap

(0.3)

(45)

14,810

announcement. While the Dow managed to creep into positive territory, the Nasdaq

Small Cap

0.1

110

15,431

pulled back off yesterdays record closing high. The mixed close by the major

averages came following the Federal Reserves widely expected decision to leave

Bankex

(0.4)

(95)

25,246

interest rates unchanged.

The European markets ended Wednesdays session with mixed results. Investors

Global Indices

Chg (%)

(Pts)

(Close)

remained cautious ahead of policy decision from the Federal Reserve. The Fed is

Dow Jones

0.0

178

20,958

widely expected to leave rates unchanged, but investors kept an eye out for clues

Nasdaq

(0.4)

(23)

6,073

regarding future rate hikes. Traders are also looking forward to the release of the

FTSE

(0.2)

(16)

7,235

U.S. jobs report for April on Friday.

Nikkei

(00.7

135

19,446

Indian markets ended a lackluster session largely unchanged on Wednesday as

Hang Seng

0.3

281

24,696

investors awaited a televised debate between France's presidential rivals and the

Shanghai Com

(0.3)

(8)

3,135

U.S. Federal Reserves rate decision.

Result Review

Advances / Declines

BSE

NSE

Alembic Pharma 4QFY17

Advances

1,322

1,751

Detailed analysis on Pg2

Declines

1,543

944

Unchanged

159

74

Investor’s Ready Reckoner

Key Domestic & Global Indicators

Volumes (` Cr)

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg6 onwards

BSE

4,236

NSE

25,272

Top Picks

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

#Net Inflows (` Cr)

Net

Mtd

Ytd

Blue Star

Capital Goods

Accumulate

681

760

11.6

FII

(5(333)

(2(333)

41,679

Dewan Housing Fin. Financials

Buy

444

520

17.0

MFs

8258

9,918

19,355

Mahindra Lifespace Real Estate

Accumulate

472

522

10.7

Navkar Corporation Others

Buy

215

265

23.3

Top Gainers

Price (`)

Chg (%)

KEI Industries

Capital Goods

Accumulate

216

239

10.3

More Top Picks on Pg4

Intellect

139

10.8

Sreinfra

103

9.6

Key Upcoming Events

Previous

Consensus

Raymond

783

8.1

Date

Region

Event Description

Reading

Expectations

Godrejprop

544

7.7

May 04, 2017 Euro Zone Euro-Zone GDP s.a. (QoQ)

0.50

0.50

Ptc

103

6.7

May 04, 2017 Germany PMI Services

54.70

54.70

May 05, 2017 China

Exports YoY%

16.40

10.00

May 05, 2017 US

Change in Nonfarm payrolls

98.00

190.00

Top Losers

Price (`)

Chg (%)

May 08, 2017 US

Unnemployment rate

4.50

4.60

Biocon

1,033

(5.0)

May 10, 2017 China

Consumer Price Index (YoY)

0.90

1.10

Adanipower

31

(4.8)

More Events on Pg5

Suntv

881

(4.6)

Amtekauto

38

(4.4)

Ipcalab

563

(4.3)

#As on May 03, 2017

Market Outlook

May 04, 2017

News Analysis

Alembic Pharmaceuticals (CMP:

`619

/ TP:

`689

/ Upside:

11.3%)

The company posted 4QFY2017 results marginally lower than expected. In rupee

terms, revenues grew by 17.8% yoy to `737cr V/s `770cr expected V/s `626cr in

4QFY2016. In sales term, the company posted growth of back of the international

formulations, which grew by 44% yoy, while the Indian domestic formulations,

grew by 6.0% yoy. API business on the other hand posted a yoy growth of 9.0%. In

domestic formulation specialty business, which formulated around 58% of the

domestic sales grew by 13.0% yoy, while acute segment which constituted around

33% of domestic formulations, dipped by 8%. The Veterinary segment which

constituted around 9% of domestic formulations, posted a yoy growth of 13.0%. In

International formulation business, US formulation business grew by 54% yoy.

On the operating front, EBITDA margin came in at 18.2% V/s 19.9% expected V/s

22.7% in 4QFY2016, a dip of 460ps qoq. The dip was mainly on back of lower

gross margins, which came in at 72.8% V/s 80.2% in 4QFY2016. Thus, PAT came

in at `93.04cr V/s `101.0cr expected V/s `91.2cr in 4QFY2016, up 2.1% yoy

Given the valuations, we maintain accumulate rating with target price of `689.

Economic and Political News

Cabinet clears ordinance to amend Banking Act to tackle NPAs

Cabinet clears new steel policy, envisages investments of `10 lakh cr.

US votes to extend anti-dumping duty on Indian shrimps for 5 years

Black money routed into gold market, shell cos after note ban: I-T sleuths

Sri Lanka to go ahead with strategic oil facility deal with India

Corporate News

L&T Technology Services to buy Silicon Valley-based firm for `180cr

Mahindra pulls the plug on electric car sales in UK

Godrej Properties sells 1,000 apartments across 3 new projects

Market Outlook

May 04, 2017

Quarterly Bloomberg Brokers Consensus Estimate

Exide Industries Ltd - May 4, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net sales

1,969

1,756

12.1

1,725

14.1

EBITDA

287

267

7.2

230

24.9

EBITDA margin (%)

14.6

15.2

13.3

Net profit

178

178

0.4

151

17.6

Housing Development Finance Corp - May 4, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net profit

2,020

2,607

(22.5)

1,701

18.7

Bharti Infratel Consol - May 8, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net sales

3,486

3,162

10.3

1,530

127.8

EBITDA

1,540

1,425

8.1

706

118.3

EBITDA margin (%)

44.2

45.1

46.1

Net profit

700

662

5.8

620

12.9

ABB India Ltd - May 8, 2017

Particulars ( ` cr)

1QCY17E

1QCY16

y-o-y (%)

4QCY16

q-o-q (%)

Net sales

2,224

1,976

12.5

2,441

(8.9)

EBITDA

195

149

30.5

282

(31.0)

EBITDA margin (%)

8.7

7.5

11.5

Net profit

92

71

29.8

147

(37.3)

Market Outlook

May 04, 2017

Top Picks ★★★★★

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its leadership

in acute therapeutic segment. Alkem expects to launch

Alkem Laboratories

23,800

1,991

2,257

13.4

more products in USA, which bodes for its international

business.

We expect the company would report strong profitability

Asian Granito

1,164

387

405

4.7

owing to better product mix, higher B2C sales and

amalgamation synergy..

Favourable outlook for the AC industry to augur well for

Cooling products business which is out pacing the market

Blue Star

6,507

681

760

11.6

growth. EMPPAC division's profitability to improve once

operating environment turns around..

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

13,916

444

520

17.0

presence in tier-II & III cities where the growth opportunity

is immense.

Strong loan growth backed by diversified loan portfolio

and adequate CAR. ROE & ROA likely to remain decent

Equitas Holdings

5,468

162

235

45.2

as risk of dilution remains low. Attractive valuations

considering growth.

Economic recovery to have favourable impact on

advertising & circulation revenue growth. Further, the

Jagran Prakashan

6,406

196

225

14.8

acquisition of a radio business (Radio City) would also

boost the company's revenue growth.

High order book execution in EPC segment, rising B2C

KEI Industries

1,682

216

239

10.3

sales and higher exports to boost the revenues and

profitability

Speedier execution and speedier sales, strong revenue

Mahindra Lifespace

1,936

472

522

10.7

visibilty in short-to-long run, attractive valuations

Massive capacity expansion along with rail advantage at

Navkar Corporation

3,065

215

265

23.3

ICD as well CFS augurs well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

1,590

1,696

1,872

10.4

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no.

2

viewership ranking in English news genre, exit from the

TV Today Network

1,589

266

344

29.1

radio business, and anticipated growth in ad spends by

corporates to benefit the stock.

Source: Company, Angel Research

Market Outlook

May 04, 2017

Key Upcoming Events

Result Calendar

Date

Company

May 4, 2017

Exide Industries, Bank of Maharashtra, MRF

May 5, 2017

Apollo Tyres, Visaka Industries, Aventis

May 6, 2017

L G Balakrishnan & Bros

Source: Bloomberg, Angel Research

Global economic events release calendar

Date

Time

Country

Event Description

Unit

Period

Bloomberg Data

Last Reported Estimated

May 4,, 2017 2:30PM Euro Zone

Euro-Zone GDP s.a. (QoQ)

% Change

1Q A

0.50

0.50

1:25PM Germany

PMI Services

Value

Apr F

54.70

54.70

May 5,, 2017

China

Exports YoY%

% Change

Apr

16.40

10.00

6:00PM US

Change in Nonfarm payrolls

Thousands

Apr

98.00

190.00

May 8,, 2017 6:00PM US

Unnemployment rate

%

Apr

4.50

4.60

May 10, 2017 7:00AM China

Consumer Price Index (YoY)

% Change

Apr

0.90

1.10

India

Imports YoY%

% Change

Apr

45.30

--

India

Exports YoY%

% Change

Apr

27.60

--

May 11, 2017

US

Producer Price Index (mom)

% Change

Apr

(0.20)

--

2:00PM UK

Industrial Production (YoY)

% Change

Mar

2.80

--

4:30PM UK

BOE Announces rates

% Ratio

May 11

0.25

--

May 12, 2017 5:30PM India

Industrial Production YoY

% Change

Mar

(1.20)

--

6:00PM US

Consumer price index (mom)

% Change

Apr

(0.30)

0.30

11:30AM Germany

GDP nsa (YoY)

% Change

1Q P

1.20

--

May 15, 2017 7:30AM China

Industrial Production (YoY)

% Change

Apr

7.60

7.00

12:00PM India

Monthly Wholesale Prices YoY%

% Change

Apr

5.70

--

May 16, 2017 6:00PM US

Housing Starts

Thousands

Apr

1,215.00

--

6:00PM US

Building permits

Thousands

Apr

1,267.00

--

6:45PM US

Industrial Production

%

Apr

0.55

--

2:00PM UK

CPI (YoY)

% Change

Apr

2.30

--

May 17, 2017 2:30PM Euro Zone

Euro-Zone CPI (YoY)

%

Apr F

1.90

--

2:00PM UK

Jobless claims change

% Change

Apr

25.50

--

May 19, 2017 7:30PM Euro Zone

Euro-Zone Consumer Confidence

Value

May A

(3.60)

--

May 23, 2017 7:30PM US

New home sales

Thousands

Apr

621.00

--

May 24, 2017 7:30PM US

Existing home sales

Million

Apr

5.71

--

2:00PM UK

GDP (YoY)

% Change

1Q P

2.10

--

Source: Bloomberg, Angel Research

Market Outlook

May 04, 2017

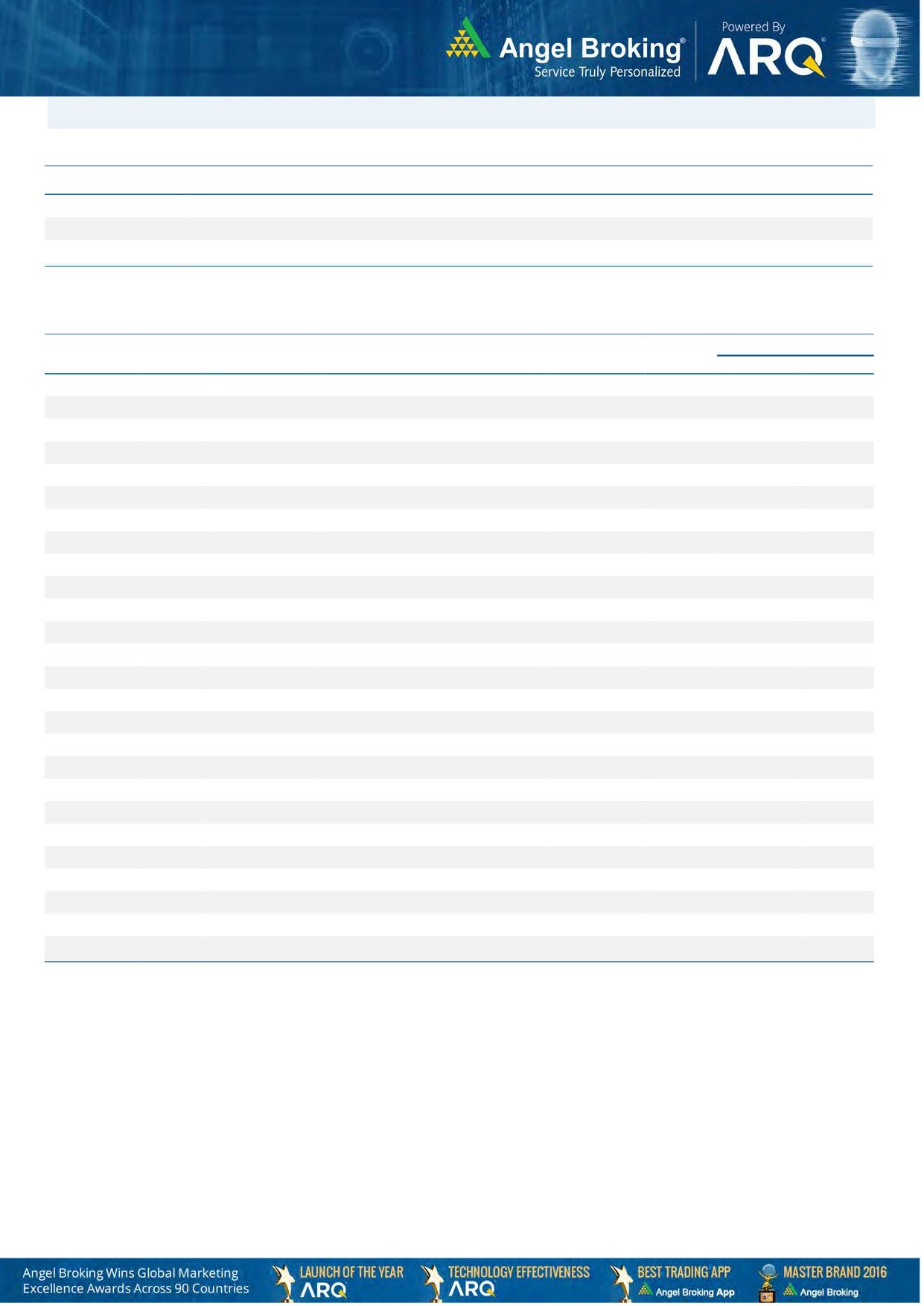

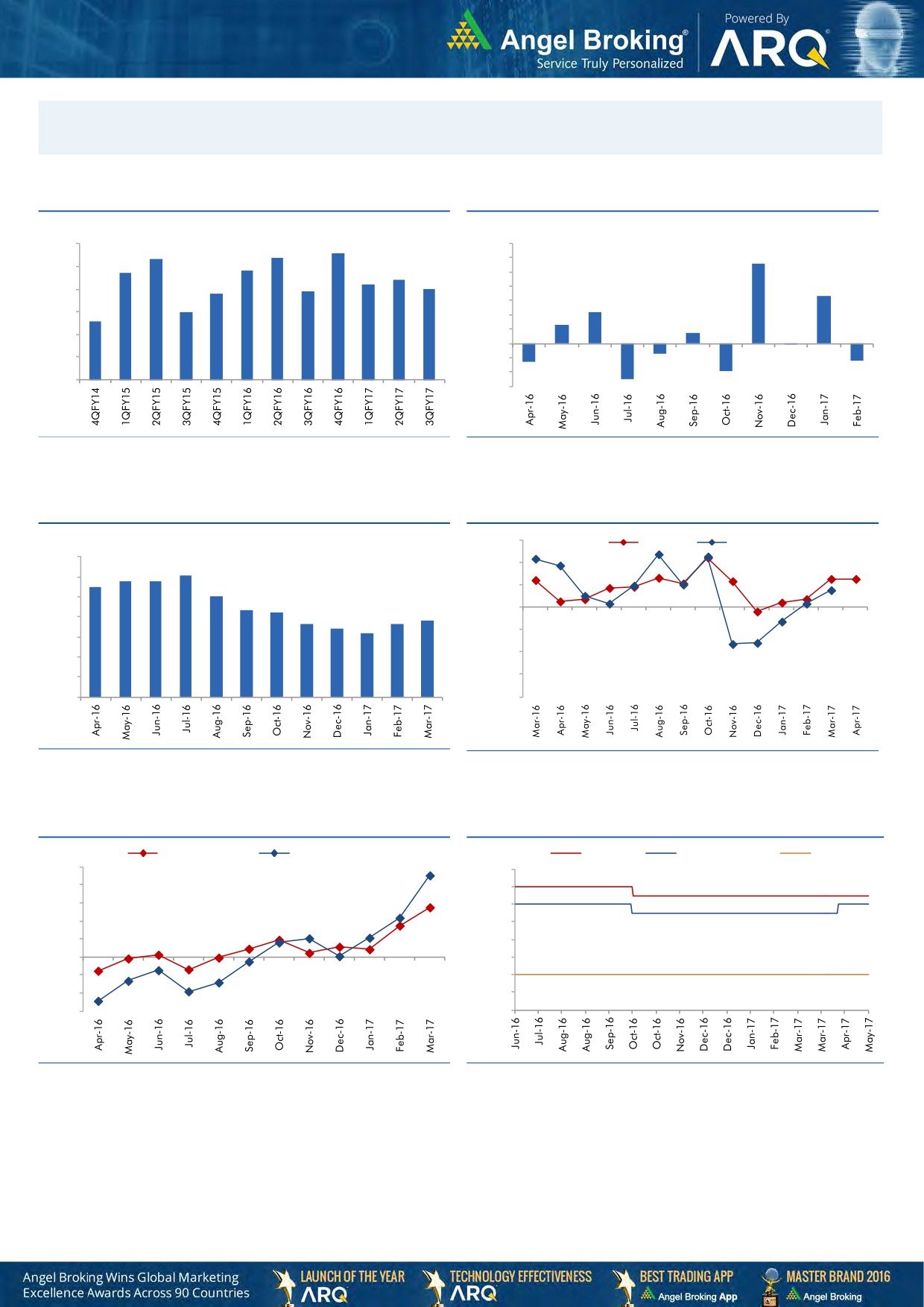

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

8.6

9.0

8.3

8.4

7.0

5.6

7.7

7.8

6.0

8.0

7.4

7.2

5.0

6.9

7.0

6.8

3.3

7.0

4.0

6.0

3.0

2.2

5.6

6.0

2.0

1.3

0.7

1.0

5.0

-

4.0

(1.0)

(0.1)

(0.7)

(2.0)

(1.3)

(1.2)

3.0

(3.0)

(1.9)

(2.5)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

(%)

56.0

Mfg. PMI

Services PMI

7.0

6.1

54.0

5.8

5.8

6.0

5.5

5.1

52.0

5.0

4.3

4.2

3.7

3.8

50.0

4.0

3.6

3.4

3.2

48.0

3.0

46.0

2.0

1.0

44.0

-

42.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

50.0

7.00

40.0

6.50

30.0

6.00

20.0

5.50

10.0

5.00

0.0

4.50

(10.0)

4.00

(20.0)

3.50

(30.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

May 04, 2017

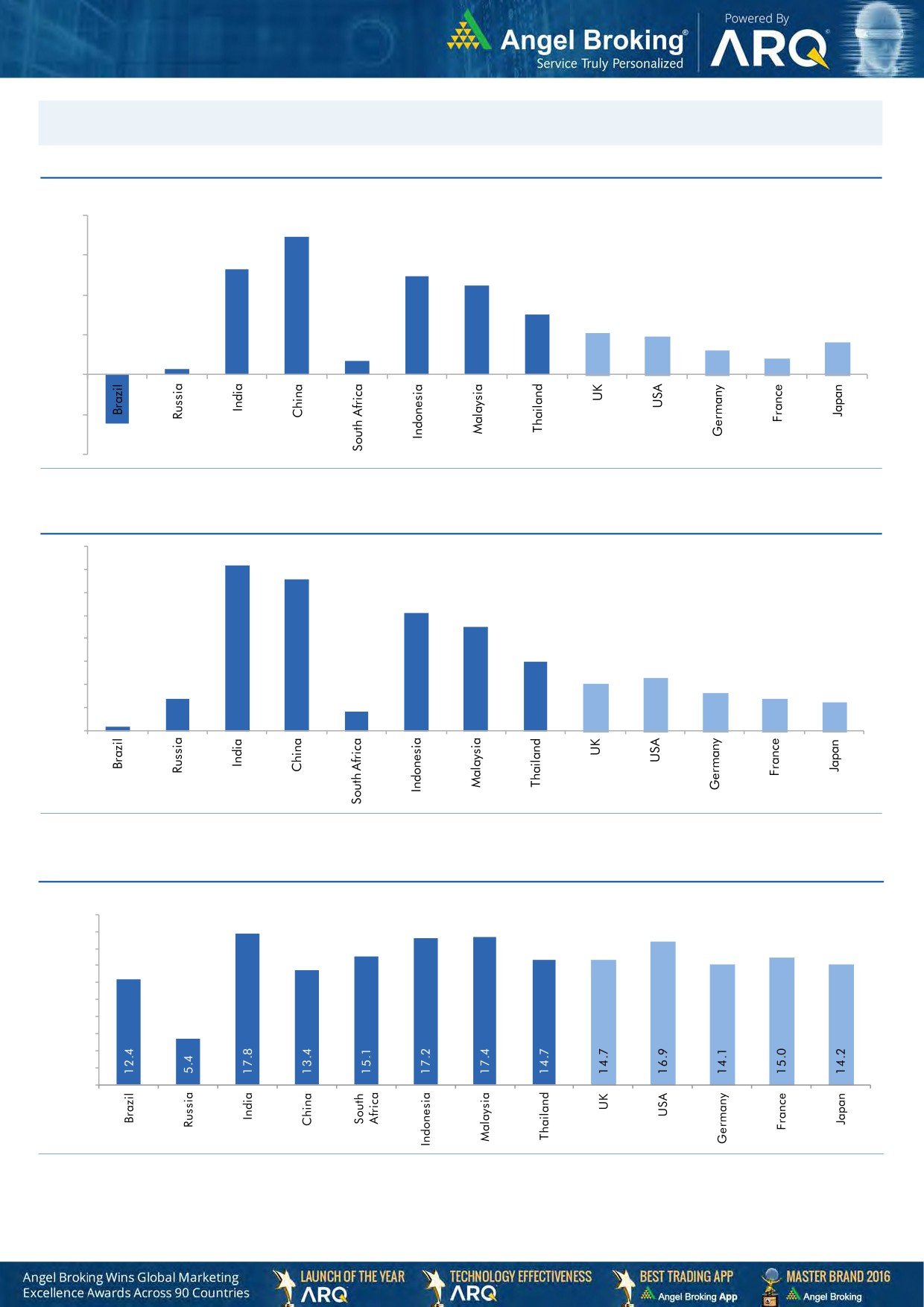

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

6.0

5.3

4.9

0.7

4.5

4.0

3.0

2.1

1.9

2.0

0.3

1.6

1.2

0.8

-

(2.0)

(2.5)

(4.0)

Source: Bloomberg, Angel Research

Exhibit 2: 2016 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

7.2

6.6

7.0

6.0

5.1

5.0

4.5

4.0

3.0

3.0

2.3

2.0

1.4

1.6

2.0

1.4

1.2

0.2

0.8

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

May 04, 2017

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

66,094

0.9

(0.1)

22.6

Russia

Micex

1,994

(0.1)

(10.8)

4.8

India

Nifty

9,312

1.8

8.2

18.7

China

Shanghai Composite

3,135

(2.8)

(0.7)

5.7

South Africa

Top 40

46,918

3.8

0.9

0.3

Mexico

Mexbol

49,100

0.1

3.1

8.3

Indonesia

LQ45

937

1.1

5.8

10.3

Malaysia

KLCI

1,773

1.9

5.1

4.7

Thailand

SET 50

994

(0.7)

(0.5)

9.3

USA

Dow Jones

20,958

1.4

5.5

18.7

UK

FTSE

7,235

(1.9)

1.6

18.3

Japan

Nikkei

19,446

2.8

2.1

10.7

Germany

DAX

12,528

2.7

7.2

25.5

France

CAC

5,301

4.6

10.8

22.8

Source: Bloomberg, Angel Research

Stock Watch

May 04, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Agri / Agri Chemical

Rallis

Neutral

238

-

4,625

1,937

2,164

13.3

14.3

9.0

11.0

26.4

21.6

4.6

4.0

18.4

19.8

2.4

2.1

United Phosphorus

Neutral

812

-

41,268

15,176

17,604

18.5

18.5

37.4

44.6

21.7

18.2

4.3

3.5

21.4

21.2

2.8

2.4

Auto & Auto Ancillary

Amara Raja Batteries

Buy

874

1,009

14,927

5,305

6,100

16.0

16.3

28.4

34.0

30.8

25.7

5.9

5.0

19.3

19.3

2.8

2.4

Apollo Tyres

Neutral

245

-

12,466

12,877

14,504

14.3

13.9

21.4

23.0

11.4

10.7

1.8

1.5

16.4

15.2

1.1

1.0

Ashok Leyland

Buy

83

111

23,592

20,021

21,915

11.6

11.9

4.5

5.3

18.4

15.6

3.8

3.3

20.6

21.5

1.1

1.0

Bajaj Auto

Neutral

2,924

-

84,599

25,093

27,891

19.5

19.2

143.9

162.5

20.3

18.0

5.7

4.9

30.3

29.4

3.1

2.7

Bharat Forge

Neutral

1,149

-

26,742

7,726

8,713

20.5

21.2

35.3

42.7

32.5

26.9

6.0

5.4

18.9

20.1

3.5

3.1

Ceat

Neutral

1,650

-

6,672

7,524

8,624

13.0

12.7

131.1

144.3

12.6

11.4

2.3

2.0

19.8

18.6

1.0

0.8

Eicher Motors

Neutral

25,915

-

70,515

16,583

20,447

17.5

18.0

598.0

745.2

43.3

34.8

14.8

11.3

41.2

38.3

4.1

3.2

Exide Industries

Neutral

222

-

18,904

7,439

8,307

15.0

15.0

8.1

9.3

27.5

23.9

3.8

3.4

14.3

16.7

2.2

1.9

Gabriel India

Neutral

124

-

1,780

1,544

1,715

9.0

9.3

5.4

6.3

22.9

19.7

4.3

3.8

18.9

19.5

1.1

1.0

Hero Motocorp

Neutral

3,368

-

67,261

28,083

30,096

15.3

15.7

171.8

187.0

19.6

18.0

6.8

5.8

30.1

27.9

2.2

2.0

Indag Rubber

Neutral

224

-

588

286

326

19.8

16.8

11.7

13.3

19.2

16.8

3.2

3.0

17.8

17.1

1.7

1.5

Jamna Auto Industries

Neutral

237

-

1,892

1,486

1,620

9.8

9.9

15.0

17.2

15.8

13.8

3.5

2.9

21.8

21.3

1.3

1.2

JK Tyres

Neutral

179

-

4,053

7,455

8,056

15.0

15.0

21.8

24.5

8.2

7.3

1.7

1.4

22.8

21.3

0.7

0.6

L G Balakrishnan & Bros Neutral

642

-

1,007

1,302

1,432

11.6

11.9

43.7

53.0

14.7

12.1

2.1

1.9

13.8

14.2

0.9

0.8

Mahindra and Mahindra Neutral

1,347

-

83,680

46,534

53,077

11.6

11.7

67.3

78.1

20.0

17.3

3.3

2.8

15.4

15.8

1.8

1.5

Maruti

Neutral

6,650

-

200,889

67,822

83,288

16.0

16.4

253.8

312.4

26.2

21.3

6.0

4.9

23.0

22.9

2.6

2.1

Minda Industries

Neutral

497

-

4,296

2,728

3,042

9.0

9.1

68.2

86.2

7.3

5.8

1.7

1.3

23.8

24.3

1.6

1.4

Motherson Sumi

Neutral

405

-

56,767

45,896

53,687

7.8

8.3

13.0

16.1

31.0

25.1

10.0

8.0

34.7

35.4

1.3

1.1

Rane Brake Lining

Neutral

1,003

-

794

511

562

11.3

11.5

28.1

30.9

35.7

32.5

5.5

5.0

15.3

15.0

1.7

1.6

Setco Automotive

Neutral

42

-

554

741

837

13.0

13.0

15.2

17.0

2.7

2.4

0.4

0.4

15.8

16.3

1.1

1.0

Subros

Neutral

236

-

1,415

1,488

1,681

11.7

11.9

6.4

7.2

36.9

32.9

3.9

3.5

10.8

11.4

1.2

1.0

Swaraj Engines

Neutral

1,829

-

2,272

660

810

15.2

16.4

54.5

72.8

33.6

25.1

10.5

9.5

31.5

39.2

3.3

2.6

Tata Motors

Neutral

447

-

128,963

300,209

338,549

8.9

8.4

42.7

54.3

10.5

8.2

1.7

1.4

15.6

17.2

0.5

0.5

TVS Motor

Neutral

499

-

23,714

13,390

15,948

6.9

7.1

12.8

16.5

39.1

30.2

9.7

7.7

26.3

27.2

1.8

1.5

Capital Goods

ACE

Neutral

63

-

624

709

814

4.1

4.6

1.4

2.1

45.1

30.1

1.9

1.8

4.4

6.0

1.0

0.9

BEML

Neutral

1,370

-

5,706

3,451

4,055

6.3

9.2

31.4

57.9

43.6

23.7

2.6

2.4

6.3

10.9

1.8

1.5

BGR Energy

Neutral

160

-

1,156

16,567

33,848

6.0

5.6

7.8

5.9

20.5

27.2

1.2

1.1

4.7

4.2

0.2

0.1

Stock Watch

May 04, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Capital Goods

Bharat Electronics

Neutral

179

-

39,948

8,137

9,169

16.8

17.2

58.7

62.5

3.1

2.9

0.5

0.4

44.6

46.3

3.9

3.5

BHEL

Neutral

174

-

42,613

28,797

34,742

-

2.8

2.3

6.9

75.7

25.2

1.3

1.2

1.3

4.8

1.1

0.8

Blue Star

Accumulate

681

760

6,507

4,283

5,077

5.9

7.3

14.9

22.1

45.7

30.8

8.9

7.5

20.4

26.4

1.6

1.3

CG Power and Industrial

Neutral

77

-

4,823

5,777

6,120

5.9

7.0

3.3

4.5

23.3

17.1

1.0

1.0

4.4

5.9

0.8

0.7

Solutions

Greaves Cotton

Neutral

171

-

4,186

1,755

1,881

16.8

16.9

7.8

8.5

22.0

20.2

4.4

4.1

20.6

20.9

2.1

1.9

Inox Wind

Neutral

200

-

4,443

5,605

6,267

15.7

16.4

24.8

30.0

8.1

6.7

2.3

1.7

25.9

24.4

0.8

0.7

KEC International

Neutral

216

-

5,556

9,294

10,186

7.9

8.1

9.9

11.9

21.8

18.2

3.2

2.8

15.6

16.3

0.8

0.8

KEI Industries

Accumulate

216

239

1,682

2,682

3,058

10.4

10.0

11.7

12.8

18.4

16.9

3.7

3.1

20.1

18.2

0.8

0.7

Thermax

Neutral

1,030

-

12,275

5,421

5,940

7.3

7.3

25.7

30.2

40.1

34.1

4.9

4.4

12.2

13.1

2.1

2.0

VATech Wabag

Neutral

684

-

3,734

3,136

3,845

8.9

9.1

26.0

35.9

26.3

19.1

3.3

2.8

13.4

15.9

1.1

0.9

Voltas

Neutral

416

-

13,755

6,511

7,514

7.9

8.7

12.9

16.3

32.2

25.5

5.8

5.1

16.7

18.5

1.9

1.6

Cement

ACC

Neutral

1,609

-

30,220

11,225

13,172

13.2

16.9

44.5

75.5

36.2

21.3

3.4

3.2

11.2

14.2

2.7

2.3

Ambuja Cements

Neutral

243

-

48,202

9,350

10,979

18.2

22.5

5.8

9.5

41.9

25.6

3.5

3.2

10.2

12.5

5.2

4.4

India Cements

Neutral

211

-

6,486

4,364

4,997

18.5

19.2

7.9

11.3

26.7

18.7

1.9

1.9

8.0

8.5

2.2

2.0

J K Lakshmi Cement

Neutral

469

-

5,522

2,913

3,412

14.5

19.5

7.5

22.5

62.6

20.9

3.9

3.2

12.5

18.0

2.5

2.1

JK Cement

Neutral

989

-

6,916

4,398

5,173

15.5

17.5

31.2

55.5

31.7

17.8

3.8

3.3

12.0

15.5

2.1

1.8

Orient Cement

Neutral

167

-

3,417

2,114

2,558

18.5

20.5

8.1

11.3

20.6

14.8

3.0

2.6

9.0

14.0

2.2

1.8

UltraTech Cement

Neutral

4,303

-

118,129

25,768

30,385

21.0

23.5

111.0

160.0

38.8

26.9

5.0

4.3

13.5

15.8

4.7

3.9

Construction

Engineers India

Neutral

170

-

11,452

1,725

1,935

16.0

19.1

11.4

13.9

14.9

12.2

2.1

2.0

13.4

15.3

5.6

5.0

Gujarat Pipavav Port

Neutral

160

-

7,728

705

788

52.2

51.7

5.0

5.6

32.0

28.5

3.2

2.8

11.2

11.2

10.6

9.0

ITNL

Neutral

114

-

3,744

8,946

10,017

31.0

31.6

8.1

9.1

14.1

12.5

0.5

0.5

4.2

5.0

3.8

3.5

KNR Constructions

Neutral

206

-

2,896

1,385

1,673

14.7

14.0

41.2

48.5

5.0

4.3

0.9

0.8

14.9

15.2

2.2

1.8

Larsen & Toubro

Neutral

1,721

-

160,579

111,017

124,908

11.0

11.0

61.1

66.7

28.2

25.8

3.4

3.1

13.1

12.9

2.5

2.3

MEP Infra

Neutral

69

-

1,116

1,877

1,943

30.6

29.8

3.0

4.2

22.9

16.4

11.1

7.5

0.6

0.6

2.0

1.8

Nagarjuna Const.

Neutral

98

-

5,456

8,842

9,775

9.1

8.8

5.3

6.4

18.5

15.3

1.5

1.3

8.2

9.1

0.8

0.7

NBCC

Neutral

200

-

18,032

7,428

9,549

7.9

8.6

8.2

11.0

24.4

18.2

1.2

1.0

28.2

28.7

2.1

1.6

PNC Infratech

Neutral

159

-

4,071

2,350

2,904

13.1

13.2

9.0

8.8

17.6

18.0

0.6

0.6

15.9

13.9

1.9

1.5

Power Mech Projects

Neutral

581

-

855

1,801

2,219

12.7

14.6

72.1

113.9

8.1

5.1

1.5

1.3

16.8

11.9

0.5

0.4

Sadbhav Engineering

Neutral

324

-

5,563

3,598

4,140

10.3

10.6

9.0

11.9

36.0

27.3

3.8

3.3

9.9

11.9

1.8

1.6

Stock Watch

May 04, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Construction

Simplex Infra

Neutral

419

-

2,075

6,829

7,954

10.5

10.5

31.4

37.4

13.4

11.2

1.4

1.3

9.9

13.4

0.7

0.6

SIPL

Neutral

101

-

3,554

1,036

1,252

65.5

66.2

(8.4)

(5.6)

3.8

4.3

(22.8)

(15.9)

11.6

9.7

Financials

Axis Bank

Buy

501

580

119,956

46,932

53,575

3.5

3.4

32.4

44.6

15.5

11.2

2.0

1.7

13.6

16.5

-

-

Bank of Baroda

Neutral

190

-

43,721

19,980

23,178

1.8

1.8

11.5

17.3

16.5

11.0

1.9

1.6

8.3

10.1

-

-

Can Fin Homes

Neutral

2,805

-

7,467

420

526

3.5

3.5

86.5

107.8

32.4

26.0

7.0

5.7

23.6

24.1

-

-

Canara Bank

Neutral

368

-

21,968

15,225

16,836

1.8

1.8

14.5

28.0

25.4

13.1

1.8

1.4

5.8

8.5

-

-

Cholamandalam Inv. &

Accumulate

1,093

1,230

17,085

2,012

2,317

6.3

6.3

42.7

53.6

25.6

20.4

4.1

3.5

16.9

18.3

-

-

Fin. Co.

Dewan Housing Finance Buy

444

520

13,916

2,225

2,688

2.9

2.9

29.7

34.6

15.0

12.8

2.4

1.6

16.1

14.8

-

-

Equitas Holdings

Buy

162

235

5,468

939

1,281

11.7

11.5

5.8

8.2

27.9

19.7

2.4

2.1

10.9

11.5

-

-

Federal Bank

Accumulate

112

125

19,315

8,259

8,995

3.0

3.0

4.3

5.6

26.1

20.0

2.2

2.0

8.5

10.1

-

-

HDFC

Neutral

1,571

-

249,587

11,475

13,450

3.4

3.4

45.3

52.5

34.7

29.9

6.7

5.9

20.2

20.5

-

-

HDFC Bank

Accumulate

1,541

1,650

395,355

46,097

55,433

4.5

4.5

58.4

68.0

26.4

22.7

4.6

3.9

18.8

18.6

-

-

ICICI Bank

Buy

273

315

158,889

42,800

44,686

3.1

3.3

18.0

21.9

15.2

12.5

2.1

1.9

11.1

12.3

-

-

Karur Vysya Bank

Buy

121

140

7,294

5,640

6,030

3.3

3.2

8.9

10.0

13.6

12.1

1.4

1.3

11.2

11.4

-

-

Lakshmi Vilas Bank

Neutral

180

-

3,451

3,339

3,799

2.7

2.8

11.0

14.0

16.4

12.9

1.7

1.6

11.2

12.7

-

-

LIC Housing Finance

Neutral

707

-

35,665

3,712

4,293

2.6

2.5

39.0

46.0

18.1

15.4

3.4

2.9

19.9

20.1

-

-

Punjab Natl.Bank

Neutral

174

-

37,080

23,532

23,595

2.3

2.4

6.8

12.6

25.6

13.8

4.0

2.8

3.3

6.5

-

-

RBL Bank

Neutral

589

-

22,105

1,783

2,309

2.6

2.6

12.7

16.4

46.4

35.9

5.1

4.5

12.8

13.3

-

-

Repco Home Finance

Accumulate

757

825

4,735

388

457

4.5

4.2

30.0

38.0

25.2

19.9

4.2

3.5

18.0

19.2

-

-

South Ind.Bank

Neutral

26

-

4,615

6,435

7,578

2.5

2.5

2.7

3.1

9.5

8.3

1.2

1.0

10.1

11.2

-

-

St Bk of India

Neutral

289

-

234,659

88,650

98,335

2.6

2.6

13.5

18.8

21.4

15.4

2.0

1.8

7.0

8.5

-

-

Union Bank

Neutral

179

-

12,278

13,450

14,925

2.3

2.3

25.5

34.5

7.0

5.2

1.0

0.9

7.5

10.2

-

-

Yes Bank

Neutral

1,632

-

74,508

8,978

11,281

3.3

3.4

74.0

90.0

22.1

18.1

4.2

3.6

17.0

17.2

-

-

FMCG

Akzo Nobel India

Neutral

1,998

-

9,581

2,955

3,309

13.3

13.7

57.2

69.3

35.0

28.8

11.4

9.6

32.7

33.3

3.0

2.7

Asian Paints

Neutral

1,116

-

107,037

17,128

18,978

16.8

16.4

19.1

20.7

58.4

53.9

20.3

19.2

34.8

35.5

6.2

5.6

Britannia

Neutral

3,574

-

42,889

9,594

11,011

14.6

14.9

80.3

94.0

44.5

38.0

18.3

14.1

41.2

-

4.3

3.7

Colgate

Neutral

1,034

-

28,118

4,605

5,149

23.4

23.4

23.8

26.9

43.4

38.4

24.0

18.8

64.8

66.8

6.0

5.4

Dabur India

Accumulate

276

304

48,583

8,315

9,405

19.8

20.7

8.1

9.2

34.1

30.0

9.5

7.9

31.6

31.0

5.5

4.8

GlaxoSmith Con*

Neutral

5,136

-

21,601

4,350

4,823

21.2

21.4

179.2

196.5

28.7

26.2

7.6

6.5

27.1

26.8

4.3

3.8

Stock Watch

May 04, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FMCG

Godrej Consumer

Neutral

1,806

-

61,519

10,235

11,428

18.4

18.6

41.1

44.2

44.0

40.9

9.8

8.2

24.9

24.8

6.1

5.4

HUL

Neutral

934

-

202,183

35,252

38,495

17.8

17.8

20.7

22.4

45.2

41.7

43.2

37.1

95.6

88.9

5.6

5.1

ITC

Neutral

277

-

336,725

40,059

44,439

38.3

39.2

9.0

10.1

30.9

27.4

8.6

7.5

27.8

27.5

7.9

7.1

Marico

Neutral

315

-

40,637

6,430

7,349

18.8

19.5

6.4

7.7

49.2

40.9

14.9

12.5

33.2

32.5

6.1

5.3

Nestle*

Neutral

6,705

-

64,645

10,073

11,807

20.7

21.5

124.8

154.2

53.7

43.5

22.1

19.8

34.8

36.7

6.2

5.3

Procter & Gamble

Neutral

7,360

-

23,892

2,939

3,342

23.2

23.0

146.2

163.7

50.3

45.0

12.7

10.6

25.3

23.5

7.7

6.7

Hygiene

Tata Global

Neutral

156

-

9,858

8,675

9,088

9.8

9.8

7.4

8.2

21.1

19.1

1.7

1.6

7.9

8.1

1.1

1.0

IT

HCL Tech^

Buy

834

1,000

118,967

49,242

57,168

20.5

20.5

55.7

64.1

15.0

13.0

3.0

2.3

20.3

17.9

2.3

1.9

Infosys

Buy

936

1,179

214,914

68,484

73,963

26.0

26.0

63.0

64.0

14.9

14.6

3.1

2.9

20.8

19.7

2.8

2.5

TCS

Accumulate

2,337

2,651

460,568

117,966

127,403

27.5

27.6

134.3

144.5

17.4

16.2

5.2

4.8

29.8

29.7

3.6

3.3

Tech Mahindra

Buy

420

600

40,888

29,673

32,937

15.5

17.0

32.8

39.9

12.8

10.5

2.5

2.2

19.6

20.7

1.1

0.9

Wipro

Accumulate

496

570

120,670

55,421

58,536

20.3

20.3

35.1

36.5

14.1

13.6

2.5

2.1

19.2

14.6

1.6

1.4

Media

D B Corp

Neutral

375

-

6,889

2,297

2,590

27.4

28.2

21.0

23.4

17.8

16.0

4.2

3.6

23.7

23.1

2.8

2.4

Hindustan Media

Neutral

286

-

2,096

1,016

1,138

24.3

25.2

27.3

30.1

10.5

9.5

2.0

1.8

16.2

15.8

1.4

1.2

Ventures

HT Media

Neutral

82

-

1,903

2,693

2,991

12.6

12.9

7.9

9.0

10.4

9.1

0.9

0.8

7.8

8.3

0.3

0.2

Jagran Prakashan

Accumulate

196

225

6,406

2,355

2,635

28.0

28.0

10.8

12.5

18.1

15.7

3.9

3.4

21.7

21.7

2.7

2.4

Sun TV Network

Neutral

881

-

34,721

2,850

3,265

70.1

71.0

26.2

30.4

33.6

29.0

8.6

7.6

24.3

25.6

11.8

10.1

TV Today Network

Buy

266

344

1,589

567

645

26.7

27.0

15.4

18.1

17.3

14.7

2.6

2.2

14.9

15.2

2.4

2.0

Metals & Mining

Coal India

Neutral

279

-

173,404

84,638

94,297

21.4

22.3

24.5

27.1

11.4

10.3

4.7

4.5

42.6

46.0

1.6

1.4

Hind. Zinc

Neutral

265

-

111,908

14,252

18,465

55.9

48.3

15.8

21.5

16.8

12.3

2.7

2.4

17.0

20.7

7.9

6.1

Hindalco

Neutral

197

-

44,182

107,899

112,095

7.4

8.2

9.2

13.0

21.4

15.2

1.0

1.0

4.8

6.6

0.9

0.9

JSW Steel

Neutral

193

-

46,725

53,201

58,779

16.1

16.2

130.6

153.7

1.5

1.3

0.2

0.2

14.0

14.4

1.6

1.4

NMDC

Neutral

128

-

40,624

6,643

7,284

44.4

47.7

7.1

7.7

18.1

16.7

1.6

1.5

8.8

9.2

3.9

3.5

SAIL

Neutral

61

-

25,338

47,528

53,738

(0.7)

2.1

(1.9)

2.6

23.6

0.7

0.6

(1.6)

3.9

1.4

1.3

Tata Steel

Neutral

441

-

42,797

121,374

121,856

7.2

8.4

18.6

34.3

23.7

12.9

1.5

1.4

6.1

10.1

1.0

1.0

Vedanta

Neutral

240

-

71,182

71,744

81,944

19.2

21.7

13.4

20.1

17.9

12.0

1.5

1.4

8.4

11.3

1.4

1.1

Oil & Gas

Cairn India

#VALUE!

9,127

10,632

4.3

20.6

8.8

11.7

3.3

4.2

GAIL

Neutral

426

-

72,117

56,220

65,198

9.3

10.1

27.1

33.3

15.7

12.8

1.4

1.3

9.3

10.7

1.5

1.2

Indian Oil Corp

Neutral

442

-

214,582

373,359

428,656

5.9

5.5

54.0

59.3

8.2

7.5

1.3

1.1

16.0

15.6

0.7

0.6

Stock Watch

May 04, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Oil & Gas

ONGC

Neutral

191

-

245,051

137,222

152,563

15.0

21.8

19.5

24.1

9.8

7.9

0.8

0.8

8.5

10.1

2.1

1.8

Reliance Industries

Neutral

1,370

-

445,514

301,963

358,039

12.1

12.6

87.7

101.7

15.6

13.5

1.6

1.5

10.7

11.3

2.0

1.6

Pharmaceuticals

Alembic Pharma

Accumulate

606

689

11,419

3,483

4,244

20.2

21.4

24.3

33.6

24.9

18.0

5.7

4.5

25.5

25.3

3.2

2.6

Alkem Laboratories Ltd

Accumulate

1,991

2,257

23,800

6,065

7,009

18.7

20.0

80.2

92.0

24.8

21.6

5.6

4.7

22.5

21.6

3.9

3.3

Aurobindo Pharma

Buy

584

877

34,230

15,720

18,078

23.7

23.7

41.4

47.3

14.1

12.4

3.7

2.9

29.6

26.1

2.4

2.1

Aventis*

Neutral

4,226

-

9,732

2,277

2,597

16.6

17.4

128.9

157.0

32.8

26.9

5.6

4.3

21.6

26.4

4.1

3.3

Cadila Healthcare

Neutral

454

-

46,452

10,429

12,318

17.7

21.6

13.1

19.2

34.6

23.6

7.3

5.8

22.8

27.1

4.5

3.7

Cipla

Sell

554

465

44,594

15,378

18,089

15.7

16.8

19.3

24.5

28.7

22.6

3.4

3.0

12.3

13.9

3.1

2.6

Dishman Pharma

Sell

306

143

4,935

1,718

1,890

22.7

22.8

9.5

11.3

32.2

27.1

3.1

2.8

10.1

10.9

3.3

2.9

Dr Reddy's

Neutral

2,594

-

42,973

16,043

18,119

18.0

23.0

78.6

130.9

33.0

19.8

3.2

2.8

10.1

15.2

2.4

2.4

GSK Pharma*

Neutral

2,422

-

20,513

2,800

3,290

10.2

20.6

32.2

60.3

75.2

40.2

13.9

13.8

17.2

34.5

7.1

6.1

Indoco Remedies

Accumulate

222

240

2,043

1,112

1,289

16.2

18.2

11.6

16.0

19.1

13.9

3.1

2.6

17.0

20.1

2.0

1.6

Ipca labs

Accumulate

563

613

7,103

3,258

3,747

12.8

15.3

12.1

19.2

46.5

29.3

2.9

2.7

6.4

9.5

2.3

2.0

Lupin

Buy

1,264

1,809

57,096

15,912

18,644

26.4

26.7

58.1

69.3

21.8

18.2

4.2

3.5

21.4

20.9

3.7

3.0

Natco Pharma

Accumulate

889

974

15,496

2,090

2,335

32.1

26.6

26.8

23.2

33.1

38.4

9.4

8.1

28.4

21.1

7.5

91.8

Sun Pharma

Buy

627

847

150,528

31,129

35,258

32.0

32.9

30.2

35.3

20.8

17.8

3.4

2.8

20.0

20.1

4.4

3.7

Power

NTPC

Neutral

162

-

133,659

86,605

95,545

17.5

20.8

11.8

13.4

13.7

12.1

1.4

1.3

10.5

11.1

2.9

2.9

Power Grid

Accumulate

211

223

110,256

25,315

29,193

88.2

88.7

14.2

17.2

14.9

12.3

2.3

2.0

15.2

16.1

9.0

8.1

Tata Power

Neutral

82

-

22,233

36,916

39,557

17.4

27.1

5.1

6.3

16.1

13.1

1.4

1.3

9.0

10.3

1.6

1.5

Real Estate

MLIFE

Accumulate

472

522

1,936

1,152

1,300

22.7

24.6

29.9

35.8

15.8

13.2

1.2

1.1

7.6

8.6

2.4

2.0

Prestige Estate

Neutral

248

-

9,287

4,707

5,105

25.2

26.0

10.3

13.0

24.0

19.1

1.9

1.8

10.3

10.2

3.1

2.8

Telecom

Bharti Airtel

Neutral

346

-

138,490

105,086

114,808

34.5

34.7

12.2

16.4

28.4

21.1

1.9

1.8

6.8

8.4

2.2

1.9

Idea Cellular

Neutral

84

-

30,217

40,133

43,731

37.2

37.1

6.4

6.5

13.1

12.9

1.1

1.0

8.2

7.6

1.8

1.5

zOthers

Abbott India

Neutral

4,121

-

8,758

3,153

3,583

14.1

14.4

152.2

182.7

27.1

22.6

133.0

113.5

25.6

26.1

2.5

2.1

Asian Granito

Neutral

387

-

1,164

1,060

1,169

12.2

12.5

12.7

15.9

30.6

24.4

2.9

2.6

9.5

10.7

1.4

1.2

Bajaj Electricals

Accumulate

349

395

3,535

4,801

5,351

5.7

6.2

10.4

13.7

33.5

25.5

4.1

3.7

12.4

14.5

0.7

0.7

Banco Products (India)

Neutral

232

-

1,661

1,353

1,471

12.3

12.4

14.5

16.3

16.0

14.3

22.1

19.9

14.5

14.6

1.2

125.6

Coffee Day Enterprises

Neutral

256

-

5,270

2,964

3,260

20.5

21.2

4.7

8.0

-

32.0

3.0

2.7

5.5

8.5

2.2

1.9

Ltd

Competent Automobiles Neutral

230

-

147

1,137

1,256

3.1

2.7

28.0

23.6

8.2

9.7

44.2

39.9

14.3

11.5

0.1

0.1

Stock Watch

May 04, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

zOthers

Elecon Engineering

Neutral

60

-

676

1,482

1,660

13.7

14.5

3.9

5.8

15.5

10.4

3.6

3.3

7.8

10.9

0.8

0.7

Finolex Cables

Neutral

529

-

8,090

2,883

3,115

12.0

12.1

14.2

18.6

37.3

28.4

19.8

17.3

15.8

14.6

2.5

2.3

Garware Wall Ropes

Neutral

784

-

1,716

863

928

15.1

15.2

36.4

39.4

21.5

19.9

3.9

3.3

17.5

15.9

1.9

1.8

Goodyear India*

Neutral

894

-

2,061

1,598

1,704

10.4

10.2

49.4

52.6

18.1

17.0

83.5

73.3

18.2

17.0

1.0

139.2

Hitachi

Neutral

1,782

-

4,845

2,081

2,433

8.8

8.9

33.4

39.9

53.4

44.7

43.0

35.9

22.1

21.4

2.3

2.0

HSIL

Neutral

345

-

2,497

2,384

2,515

15.8

16.3

15.3

19.4

22.6

17.8

22.4

19.3

7.8

9.3

1.2

1.1

Interglobe Aviation

Neutral

1,116

-

40,342

21,122

26,005

14.5

27.6

110.7

132.1

10.1

8.5

60.3

43.1

168.5

201.1

1.9

1.5

Jyothy Laboratories

Neutral

376

-

6,839

1,440

2,052

11.5

13.0

8.5

10.0

44.3

37.6

10.7

9.9

18.6

19.3

5.0

3.5

Kirloskar Engines India

Neutral

402

-

5,812

2,554

2,800

9.9

10.0

10.5

12.1

38.3

33.2

16.0

15.1

10.7

11.7

1.9

1.7

Ltd

Linc Pen & Plastics

Neutral

293

-

433

382

420

9.3

9.5

13.5

15.7

21.7

18.6

3.7

3.2

17.1

17.3

1.2

1.1

M M Forgings

Neutral

630

-

761

546

608

20.4

20.7

41.3

48.7

15.3

12.9

86.3

76.4

16.6

17.0

1.2

1.1

Manpasand Bever.

Neutral

697

-

3,989

836

1,087

19.6

19.4

16.9

23.8

41.3

29.3

5.0

4.3

12.0

14.8

4.5

3.4

Mirza International

Neutral

116

-

1,393

963

1,069

17.2

18.0

6.1

7.5

18.9

15.4

2.9

2.5

15.0

15.7

1.7

1.5

MT Educare

Neutral

81

-

323

366

417

17.7

18.2

9.4

10.8

8.7

7.5

1.9

1.7

22.2

22.3

0.8

0.7

Narayana Hrudaya

Neutral

316

-

6,458

1,873

2,166

11.5

11.7

2.6

4.0

119.5

79.7

7.3

6.6

6.1

8.3

3.5

3.1

Navkar Corporation

Buy

215

265

3,065

369

561

42.9

42.3

6.9

11.5

31.1

18.7

2.2

2.0

7.4

10.5

9.3

6.1

Navneet Education

Neutral

169

-

3,944

1,062

1,147

24.0

24.0

6.1

6.6

27.7

25.5

5.7

5.0

20.6

19.8

3.8

3.5

Nilkamal

Neutral

2,185

-

3,261

1,995

2,165

10.7

10.4

69.8

80.6

31.3

27.1

124.9

108.5

16.6

16.5

1.6

1.5

Page Industries

Neutral

14,714

-

16,411

2,450

3,124

20.1

17.6

299.0

310.0

49.2

47.5

327.7

250.2

47.1

87.5

6.7

5.3

Parag Milk Foods

Neutral

238

-

2,001

1,919

2,231

9.3

9.6

9.5

12.9

25.2

18.4

3.9

3.2

15.5

17.5

1.2

1.0

Quick Heal

Neutral

247

-

1,732

408

495

27.3

27.0

7.7

8.8

31.9

28.1

3.0

3.0

9.3

10.6

3.4

2.8

Radico Khaitan

Buy

123

147

1,639

1,667

1,824

13.0

13.2

6.7

8.2

18.5

15.1

1.7

1.5

9.0

10.2

1.4

1.2

Relaxo Footwears

Neutral

490

-

5,883

2,085

2,469

9.2

8.2

7.6

8.0

64.8

61.6

25.1

21.4

17.9

18.8

2.9

2.5

S H Kelkar & Co.

Neutral

312

-

4,514

1,036

1,160

15.1

15.0

6.1

7.2

51.1

43.5

5.5

5.0

10.7

11.5

4.2

3.7

Siyaram Silk Mills

Accumulate

1,696

1,872

1,590

1,652

1,857

11.6

11.7

92.4

110.1

18.3

15.4

2.7

2.3

14.7

15.2

1.2

1.0

Styrolution ABS India*

Neutral

726

-

1,277

1,440

1,537

9.2

9.0

40.6

42.6

17.9

17.0

45.7

41.5

12.3

11.6

0.8

0.7

Surya Roshni

Neutral

275

-

1,206

3,342

3,625

7.8

7.5

17.3

19.8

15.9

13.9

30.2

24.3

10.5

10.8

0.6

0.6

Team Lease Serv.

Neutral

1,092

-

1,867

3,229

4,001

1.5

1.8

22.8

32.8

48.0

33.3

5.1

4.5

10.7

13.4

0.5

0.4

The Byke Hospitality

Neutral

211

-

845

287

384

20.5

20.5

7.6

10.7

27.7

19.7

5.8

4.7

20.7

23.5

3.0

2.2

Stock Watch

May 04, 2017

Company Name

Reco

CMP

Target Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E

zOthers

Transport Corporation of

Neutral

256

-

1,960

2,671

2,911

8.5

8.8

13.9

15.7

18.5

16.4

2.5

2.3

13.7

13.8

0.8

0.8

India

TVS Srichakra

Neutral

4,137

-

3,168

2,304

2,614

13.7

13.8

231.1

266.6

17.9

15.5

464.8

366.0

33.9

29.3

1.4

1.2

UFO Moviez

Neutral

440

-

1,214

619

685

33.2

33.4

30.0

34.9

14.7

12.6

2.0

1.8

13.8

13.9

1.7

1.3

Visaka Industries

Neutral

328

-

520

1,051

1,138

10.3

10.4

21.0

23.1

15.6

14.2

42.0

39.3

9.0

9.2

0.8

0.7

VRL Logistics

Neutral

339

-

3,093

1,902

2,119

16.7

16.6

14.6

16.8

23.3

20.1

5.1

4.5

21.9

22.2

1.7

1.5

Wonderla Holidays

Neutral

381

-

2,153

287

355

38.0

40.0

11.3

14.2

33.7

26.8

4.8

4.2

21.4

23.9

7.2

5.8

VIP Industries

Neutral

209

-

2,955

1,270

1,450

10.4

10.4

5.6

6.5

37.3

32.2

7.7

6.8

20.7

21.1

2.3

2.0

Navin Fluorine

Buy

3,027

3,650

2,963

789

945

21.1

22.4

120.1

143.4

25.2

21.1

4.1

3.5

17.8

18.5

3.7

3.0

Source: Company, Angel Research; Note: *December year end; #September year end; &October year end; Price as on May 03, 2017

Market Outlook

May 04, 2017

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited,Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.